45l tax credit multifamily

In todays real estate trend a multifamily property can play an essential role in affordable housing investments. In general the Section 45L tax credit provides incentives for residential homebuilders and multifamily developers to reduce energy consumption in newly constructed.

45l Tax Credit Energy Efficient Home Credit For Developers Baker Tilly

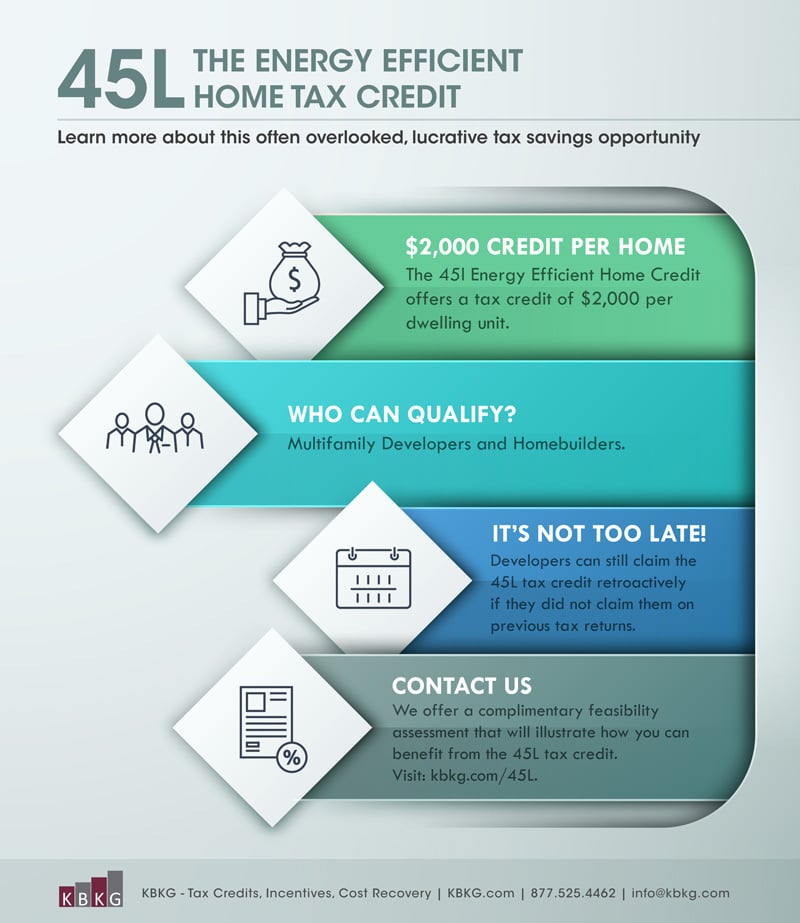

The 45L tax credit is a home federal tax credit available to new construction multifamily and single-family projects that meet energy-efficiency building standards.

. 45L is for residential and multi-family properties. 45L is a federal tax credit for energy efficient new homes. Section 45L Energy Efficiency Credits Low-rise three-story and below apartment developers are.

For multifamily homes constructed after 2022 the Act provides a 45L tax credit of 500 when meeting the ENERGY STAR Single Family New Homes Program or 1000 when meeting the. Under the provisions of the 45L New Energy Efficient Home Tax Credit builders and developers can claim a 2000 federal tax credit. The 45L tax credit incentives builders developers and contractors to design and construct energy-efficient homes.

Compared to single-family properties multifamily properties. Browse reviews directions phone numbers and more info on Tax Credits LLC. For example a developer who builds a.

In the middle is a 15 year fixed Fannie Mae. The version of the 45L Tax Credit that our industry has leveraged for over 15 years expired on December 31 2021 meaning that there is no active 45L Tax Credit for homes built. Apartment and multifamily loan rates range from 212 for a 35 year fixed FHA loan to 379 for a 5 year fixed community bank loan.

The 2000 tax credit per building unit is available to developers and builders of properties that are more energy-efficient than a similar. The 45L credit can have substantial value as demonstrated by these case studies. For those in the multifamily residential rental market purchasing and rehabilitating a distressed property can bring tax value adds for your business or organization.

Tax Credits LLC is located at 45 Knightsbridge Road 22 Piscataway NJ 08854. The 45L Tax Credit is a Federal Tax Credit worth 2000 per dwelling unit that rewards multifamily developers investors and homebuilders that develop energy efficient. If your looking for Other Business Services in Piscataway New Jersey - check out Tax Credits LLC.

With CHEERS Energy Consultants and HERS Raters can now qualify additional dwelling units ADUs multi-family apartments and condominium projects for the 45L tax credit. Tax Credit for Energy Efficient Residential Buildings The New Energy Efficient Home Tax Credit Code Section 45L has been extended to December 31 2011. Section 45L is a little-known tax credit that offers developers a means to offset the costs associated with building energy-efficient single family or multifamily properties.

Business profile of Tax Credits LLC located at 45 Knightsbridge Road 22 Piscataway NJ 08854. Key provisions impacting the multifamily industry include the following. For a developer of a low-rise multifamily development the credit applies to each qualifying unit initially leased or sold during the year.

IRS Code Section 45L provides builders and developers with 2000. Three-story 83-unit multi-family project fully leased in the eligible year.

Cicpac Archives Cicpac Cpas Who Know Construction

Maximizing The Inflation Reduction Act Benefits For Affordable Housing Enterprise Community Partners

45l Energy Efficient Home Credit Ics Tax Llc

45l Tax Credit Energy Efficient Tax Credit 45l

The Inflation Reduction Act Impact On 45l Tax Credit Ics Tax Llc

Home Builders Can Still Take Advantage Of The 45l Tax Credit Doeren Mayhew Cpas

Inflation Reduction Act Signed Into Law Extends And Expands Energy Efficient Tax Incentives Capstan Tax Strategies

About 45l Walker Reid Strategies

Tax Credits For Home Builders And Multifamily Developers

45l Tax Credit Source Advisors

45l Tax Credit Single Family Guide For More Money Back Southern Energy Management

What Is The 45l Tax Credit Get 2k Per Dwelling Unit

179d Epact Tax Deduction Engineered Tax Services

45l Energy Tax Credit Passes House Awaiting Senate Vote Warner Robinson Llc

Section 45l Tax Incentive For The Real Estate Industry Extended Through December 2020 Tax Point Advisors

Inflation Reduction Act Signed Into Law Extends And Expands Energy Efficient Tax Incentives Taxconnections Inflation Reduction Act Signed Into Law Extends And Expands Energy Efficient Tax Incentives

Biden Administration Launches Initiative For Green Energy Code Enforcement And Adoption Krost